Processes

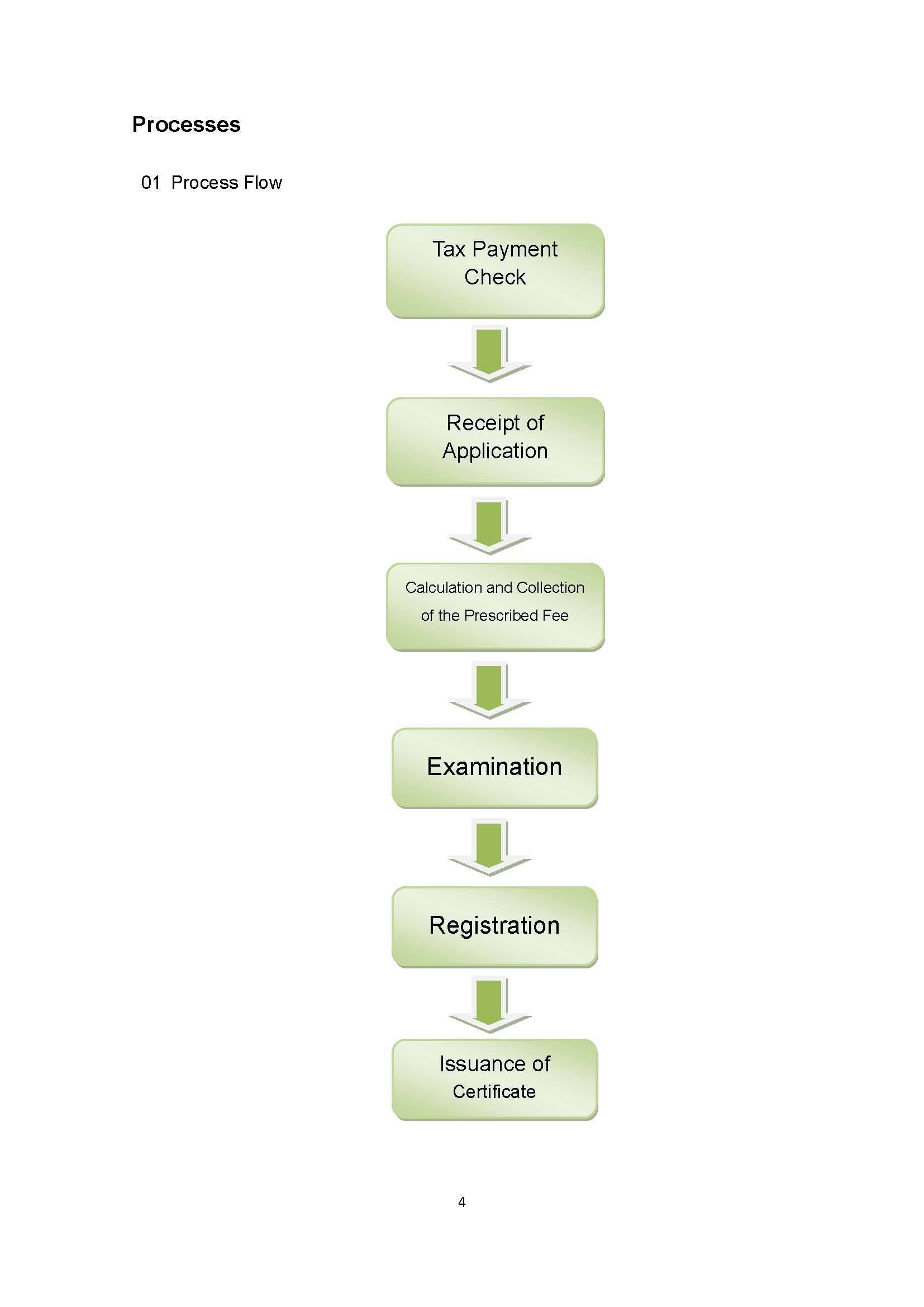

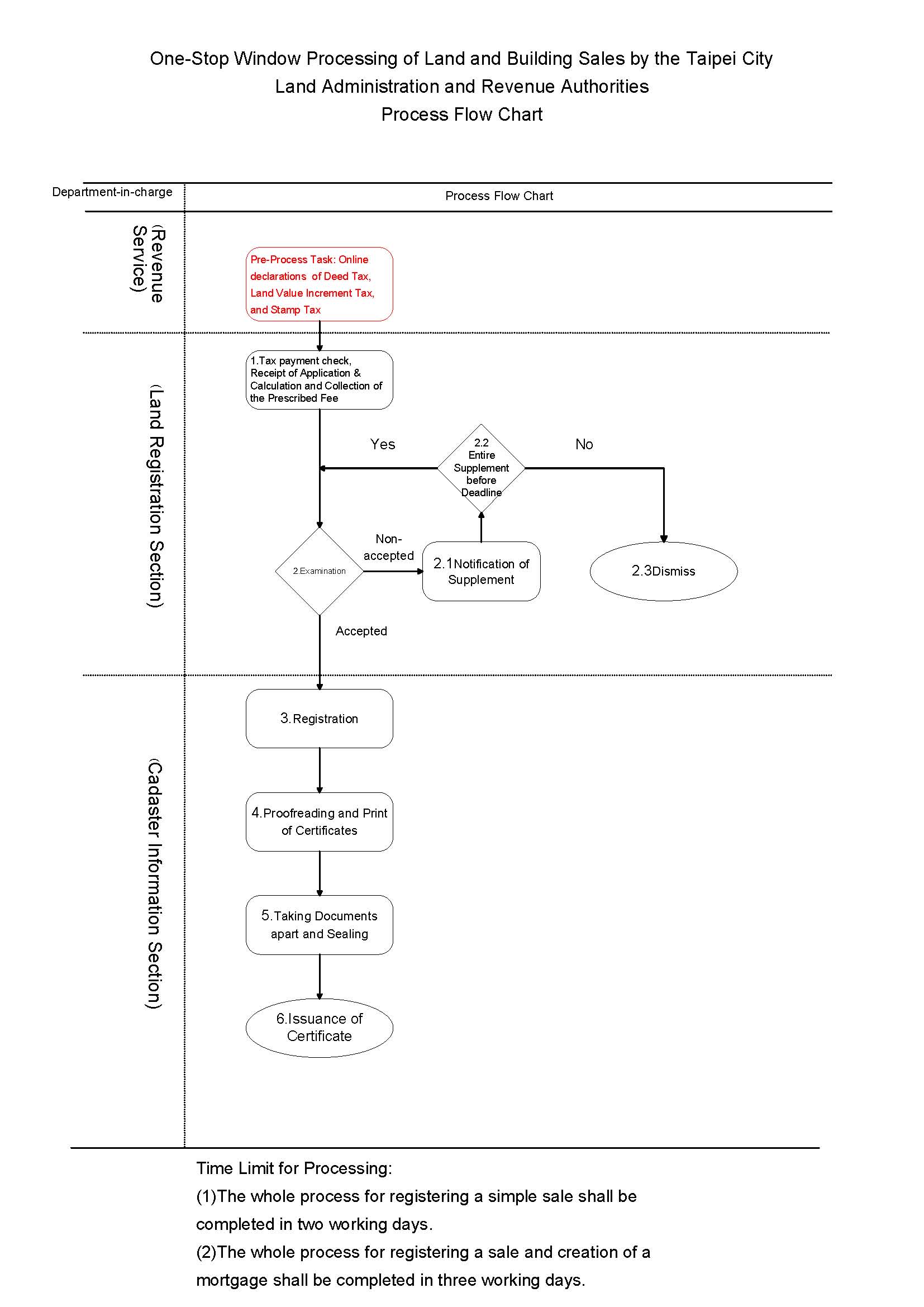

01 Process Flow Tax Payment Check > Receipt of Application > Calculation and Collection of the Prescribed Fee > Examination > Registration > Issuance of Certificate 02 Process Descriptions Tax Payment Check: The applicant or the applicant’s representative files a tax declaration via the Local Tax Online Declaration System, prints out the forms for payment of land value increment tax, deed tax, and stamp duty, and after paying the taxes, takes the tax payment receipts and the Land Value Increment Declaration Form stamped with the seals of the obligor and obligee, the Deed Tax Declaration Form stamped with the seal of the obligee, and the original of the Contract for the Sale and Transfer of Ownership of Land and Constructional Improvement to the revenue service desk of any district land office in Taipei to complete the tax process. Receipt of Application: The applicant delivers the documents to the full-function counter. Calculation and Collection of the Prescribed Fee: For land, one thousandth of the declared value; for buildings, one thousandth of the value as approved by the revenue service for the payment of deed tax. Examination: Applications are examined by the land office, which will notify the applicant of any deficiency that may be corrected, and the applicant may make correction or supplementation one time. Registration: Registration will be carried out by the land office upon completing the examination and finding no deficiency. Issuance of Certificate: The land office will issue a certificate upon completion of registration. 03 Processing Flowchart 04 Time Limit for Processing The whole process for registering a simple sale shall be completed in two working days.

The whole process for registering a sale and creation of a mortgage shall be completed in three working days.